Under the terms of the Agreement, each Renewables' Share ("RNW Share") will be exchanged for, at the election of each holder of RNW Shares (“RNW Shareholders”):

- 1.0337 common shares of TransAlta (each a "TransAlta Share"), or

- $13.00 in cash.

The consideration payable to RNW Shareholders is subject to pro-rationing based on a maximum aggregate number of TransAlta Shares that may be issued to RNW Shareholders of 46,441,779 and a maximum aggregate amount of cash of $800 million.

The transaction will be effected by way of an arrangement under the Canada Business Corporations Act (the “Arrangement”).

The consideration payable to RNW Shareholders represents an 18.3% premium based on the closing price of RNW Shares on the Toronto Stock Exchange (“TSX”) as of July 10, 2023.

The total consideration paid to RNW Shareholders is valued at $1,384,051,812 on July 10, 2023, of which $800 million will be paid in cash. The combined company will operate as TransAlta and remain listed on the TSX and the New York Stock Exchange ("NYSE"), under the symbols “TA” and “TAC”, respectively.

Key Highlights and Rationale for Arrangement

The Arrangement provides shareholders of the combined company with a single strategy and a clear and compelling opportunity for long-term growth:

- Alignment and Execution of a Single Strategy: The combined company will share a common strategic path to achieve its clean electricity growth objectives and be more competitive as a single, streamlined, publicly-listed entity. It will align, clarify and enhance management's strategic focus and efforts in the marketing, development, construction, operation and maintenance of generation assets to serve customers with clean and reliable electricity.

- Accretive Transaction and Attractive Dividend, while Supporting Future Growth: Following the transaction, shareholders of the combined company will benefit from an accretive transaction and receive a sustainable quarterly dividend while ensuring the combined company retains sufficient cash flow for reinvestment in future growth projects.

- Direct Ownership in One of Canada's Largest Independent Power Producers: The combined company will have unified and direct ownership interests in a diversified portfolio of wind, hydro, solar, storage and natural gas generation assets, all backed by an aligned, strategy that allows shareholders of the combined company to benefit from future growth.

- Increased Scale, Public Float and Liquidity: The combined company will have a larger market capitalization and will provide stronger access to capital markets while providing increased trading liquidity. The reduced corporate complexity will provide greater transparency and understanding of the combined company's business, which is expected to enable investment in TransAlta's growing clean electricity portfolio.

- Synergies: The combined company will benefit from greater efficiencies and corporate synergies under a single entity. The combined company will create opportunities for further capital efficiencies by funding growth in a single simplified entity, providing a higher retention of cash flows, and resulting in lower corporate and administration costs.

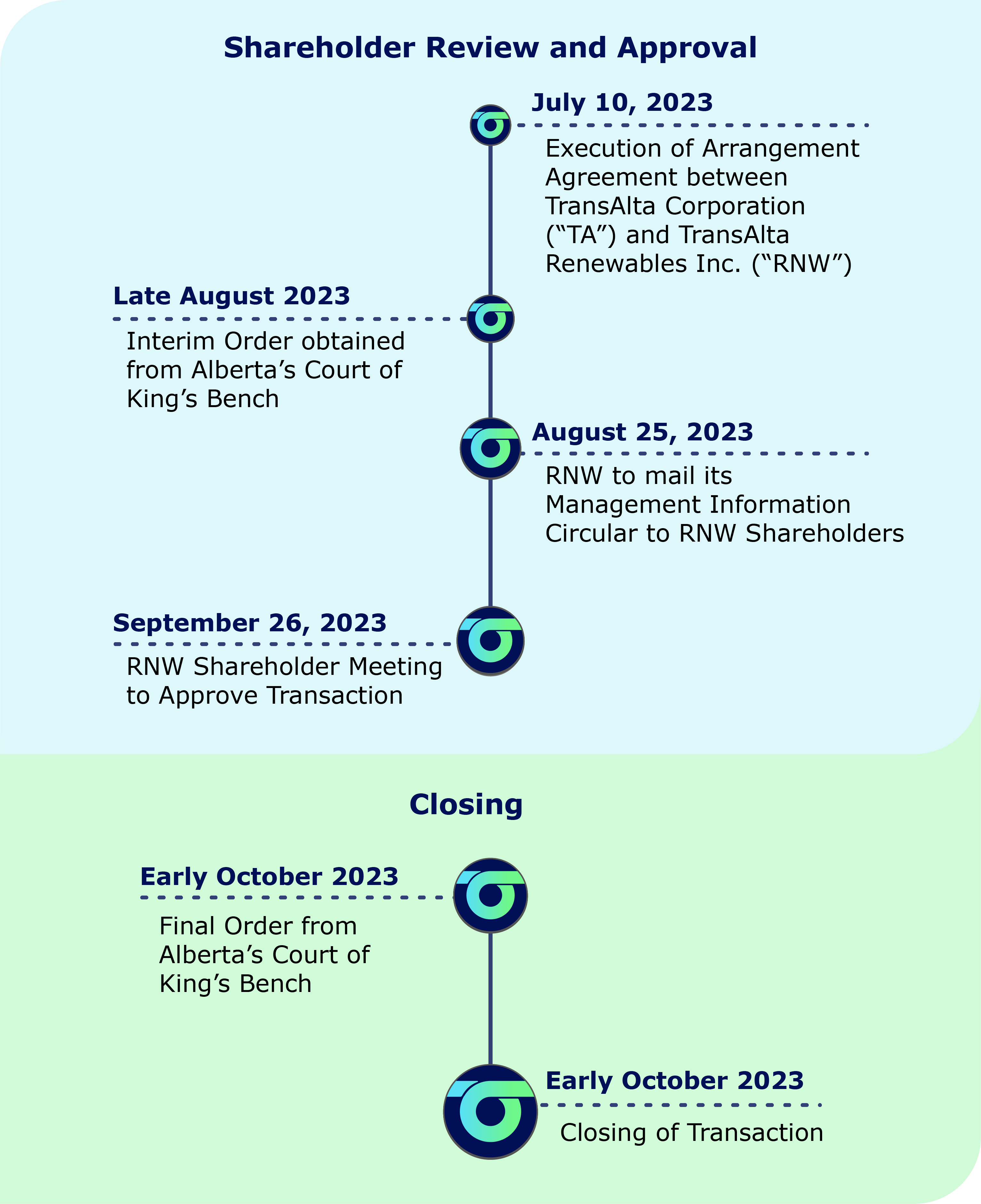

Timeline